An Agent-First Platform

Built So You Could Build A

Dream Organization

We put the agent first at PaymentClub, and this is part of our core business model. We find that as the agent grows we grow, and as the agent struggles, we struggle. So it made sense many years ago to develop a platform that works for the independent agent in a way that is flexible, secure and built for growth.

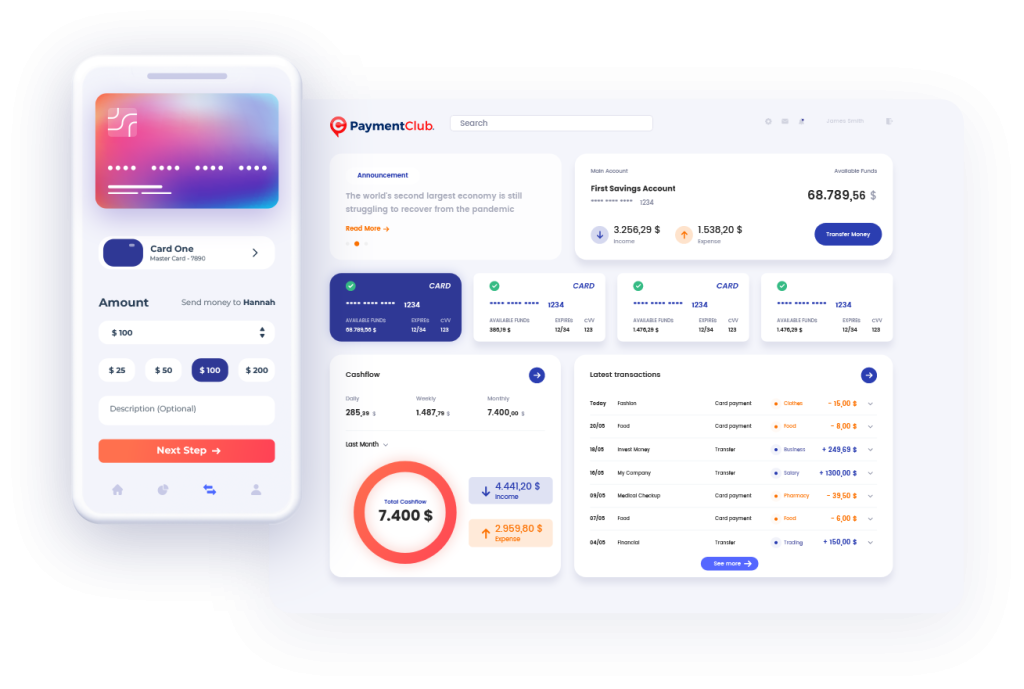

At PaymentClub Agents Get the Best Tech

Why settle for outdated technology and terminals, when you can partner with a true innovator in the industry. We provide the latest technology to agents such as PayFac, gateways, comprehensive dashboards, and modernized terminals and iOS devices.

Growth Hack Your Business

Leverage our state-of-the-art tools to obtain, manage and analyze your merchant accounts in a single place. Utilize the PaymentClub platform to supercharge your business growth.

Need More Info? Download Our Guide Today!

In the Beginner's Guide to the Payments Industry, we share all you need to know about the merchant services business sector. We'll get you up to speed quickly with different fees associated with credit card transactions. Further, we'll walk you through what it means to be an independent sales organization. Finally, we'll give you an idea of the different pricing structures you can expect when working with PaymentClub.

Marketing Tools

Stay ahead of the pack with robust marketing tools geared to close sales faster. We offer a dedicated website portal for you to order branded stationary, brochures, product sheets, web designs, and more.

Residual-Based Financing

When Agents need to raise money they shouldn't have to spend their valuable time searching for a way. In partnership with a lender we are proud to offer PaymentClub's ClubCash Solutions, a program that allows our partners and agents to borrow money, usually up to ten times their monthly residuals.

The borrowing partner’s loan payments are paid monthly from their residuals until the loan is paid off. The partner, by not selling their stake, has retained 100% of their original residuals, plus 100% of their growth. Without having to sell your residuals, give up equity and control, or embrace an added business partner, you can borrow and grow with PaymentClub.

Built to Grow Big

Meet PaymentClub HQ

Do more with PaymentClub HQ. The unified data dashboard offers a comprehensive back-office solution for Independent Sales Organizations. With PaymentClub HQ ISOs can quickly and seamlessly board merchants on either TSYS or First Data processing platforms.

With PaymentClub HQ you can expect paperless boarding and underwriting cutting approval times down significantly.

Access the Merchant Library where ISOs can safely store and retrieve any agreement, form or contract, related to any of the ISO’s merchants. Further, the PaymentClub HQ dashboard platform provides users with merchant pricing, residuals calculation and risk management modules, which take care of most of their day-to-day operations.