How to Fast-Track Your PPP Loan Application with PaymentClub + Womply

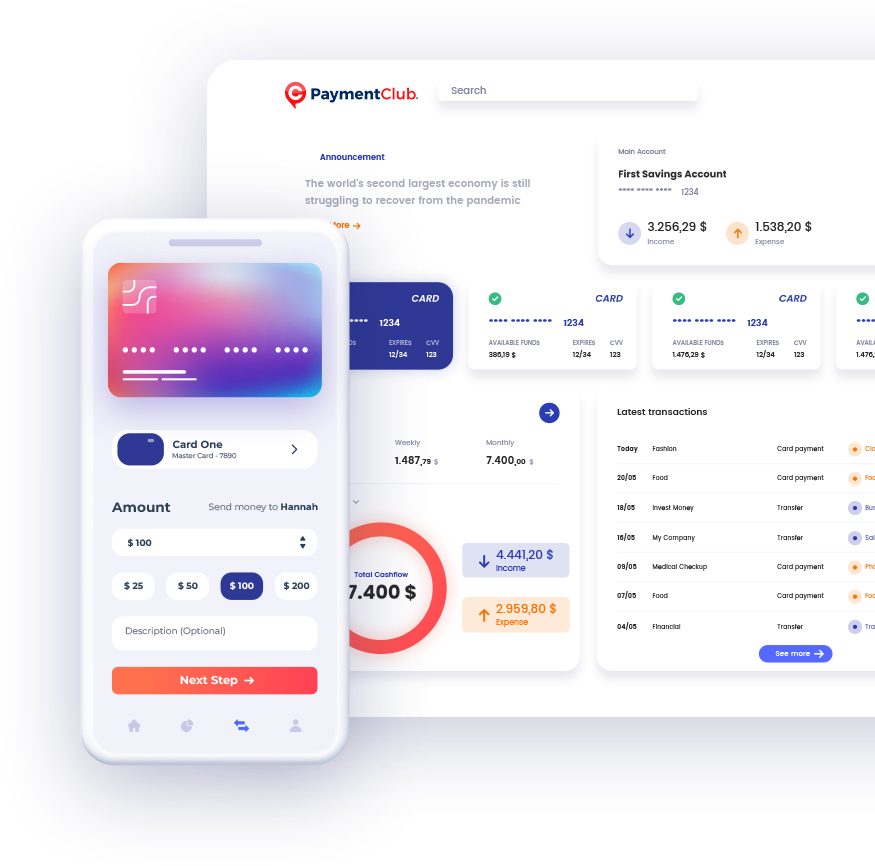

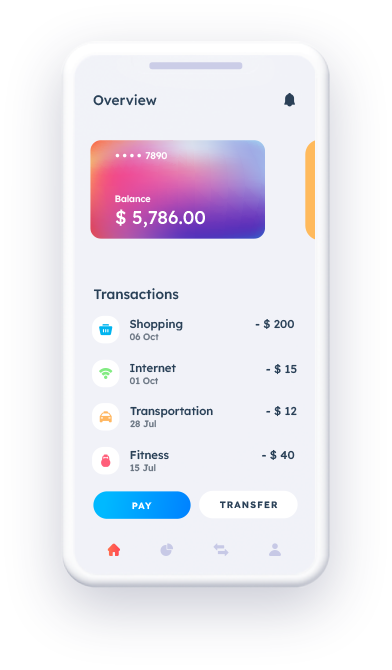

Payment Protection Program (PPP) Loans have helped businesses across the country keep their doors open and their employees on board during the COVID-19 pandemic. PaymentClub is proud to introduce a partnership Womply to facilitate and expedite PPP loan applications. Read on to learn more about how the program works, and how you can apply today.